What Your Grocery Shopping Mindset Reveals About Your Financial Outlook

The simple act of grocery shopping is often seen as a mundane, everyday task, however, your approach to filling your cart speaks volumes about your financial mindset and beliefs about money. In this article we will unpack some of these beliefs to give you more insight into how they relate to your finances.

Brand Loyalty

Brand loyalty is more than just a preference for a familiar product, it can reveal a sense of stability and a value-driven approach to spending. Those who gravitate toward trusted brands may feel that the quality or reliability of the product justifies the cost. This mindset suggests financial security that allows for prioritising value over price. However, for some, it may also reflect a resistance to change or a belief that quality always comes at a premium, a notion worth reconsidering in an era where inflation has made many household staples a luxury.

Bargain Hunting

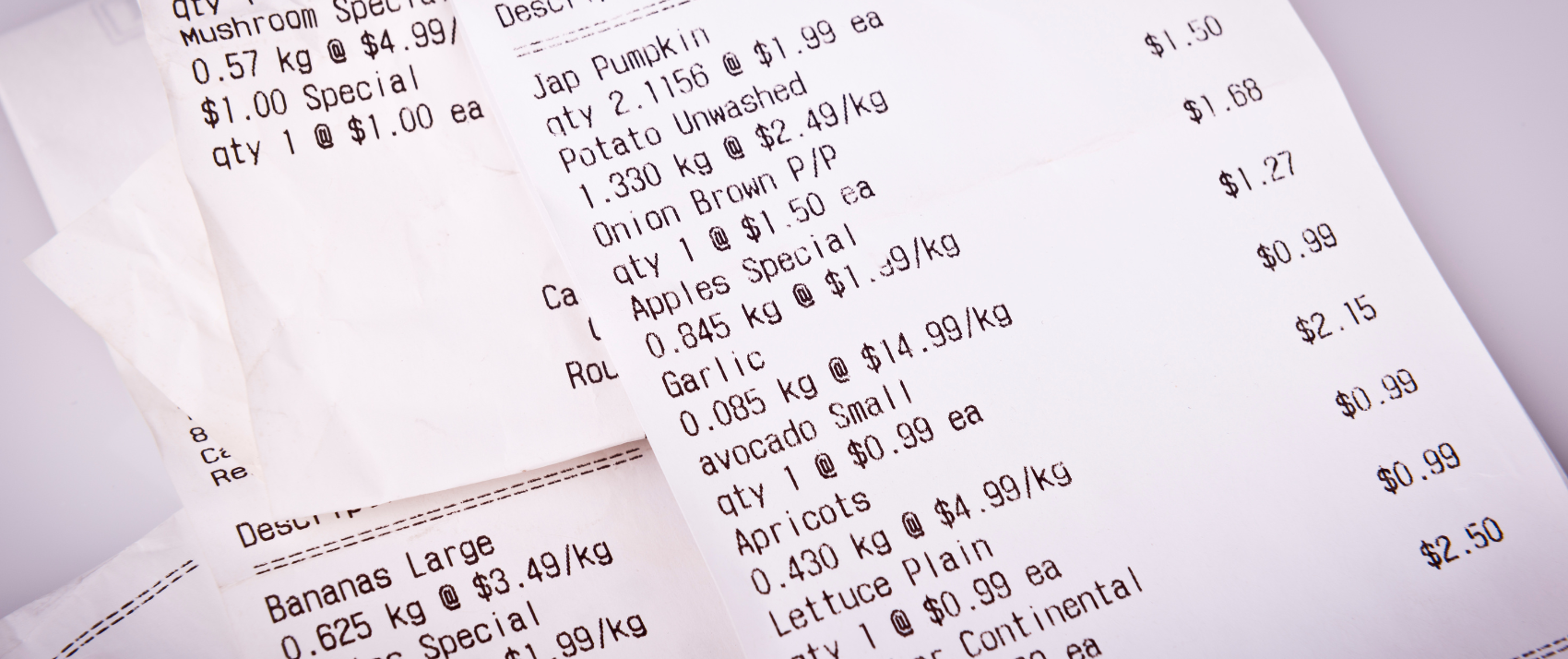

On the other hand, some shoppers are laser-focused on finding the best deals, scouring aisles for items marked “on special.” This approach reflects a cost-conscious mindset, often shaped by necessity rather than choice. For many, this strategy is about survival, especially as inflation tightens household budgets. While it demonstrates adaptability and resourcefulness, it can sometimes lead to impulsive purchases of items not initially needed, potentially derailing a carefully planned budget.

Bulk Buyers

Those who opt to buy in bulk often embrace a long-term financial strategy. Bulk buying can lead to significant savings, especially for non-perishable items. This habit may indicate a proactive approach to money management, often requiring upfront financial freedom to capitalise on savings. However, for those with limited storage or cash flow, this strategy may not be practical, highlighting how personal circumstances dictate financial behaviour.

The “as and when” Shopper

Shoppers who buy items only when they are needed, often exhibit a just-in-time approach to both shopping and finances. This behaviour might stem from a belief in living in the moment, avoiding waste, or simply not having the financial bandwidth to plan ahead. While it offers flexibility, this approach can also lead to higher costs over time, as smaller, frequent purchases may lack the benefit of bulk discounts or specials.

Budget vs. Opportunity

Do you walk into the store with a meticulously planned budget, or do you allow yourself the freedom to seize a good deal when it appears? Shoppers with a set budget reflect a disciplined approach to finances, often shaped by necessity or a deeply ingrained belief in the importance of financial control. Conversely, those who shop with flexibility may feel financially secure enough to adapt their spending based on what they find.

However, these mindsets aren’t mutually exclusive, a budget-conscious shopper can still capitalise on a great deal, and an opportunistic shopper can exercise restraint when needed. The balance often depends on the state of their overall financial health.

The Inflation Factor

It would be remiss to discuss grocery shopping habits without acknowledging the elephant in the room: inflation. Rising costs of food and essentials have forced many households to rethink their shopping strategies entirely. The increasing need to stretch every rand underscores that, for many, shopping habits are not just a reflection of mindset but a direct response to economic pressure.

Inflation has blurred the lines between choice and necessity. The brand loyalist might find themselves trading down to house brands, and the bulk buyer may have to scale back due to rising costs. Meanwhile, bargain hunters and budget shoppers have become even more vigilant, embodying the resilience of households facing financial constraints.

Your approach to grocery shopping is a microcosm of your broader financial beliefs. Whether you prioritise quality, deals, planning, or flexibility, these choices are influenced by your mindset and external economic realities. While no single approach is inherently right or wrong, understanding your shopping habits can provide valuable insights into your financial behaviour and opportunities for growth.